Update - Closed Session Meeting on Land Aquisition - Tuesday, December 20

The Board of Education met last night in closed session, as authorized by Section 19.85(1)(c) of Wisconsin Statutes, to discuss approaches and alternatives for the acquisition of a new high school site. A request is in process to determine cost associated with site work for sites under consideration.

There is no scheduled Meeting of the Electors at this time. When the Board of Education is able to determine the property which best suits the needs of the District and community, based on availability, location, and costs, it will be announced and a meeting will be scheduled as a Class 2 Notice at least 14 days prior to the meeting date.

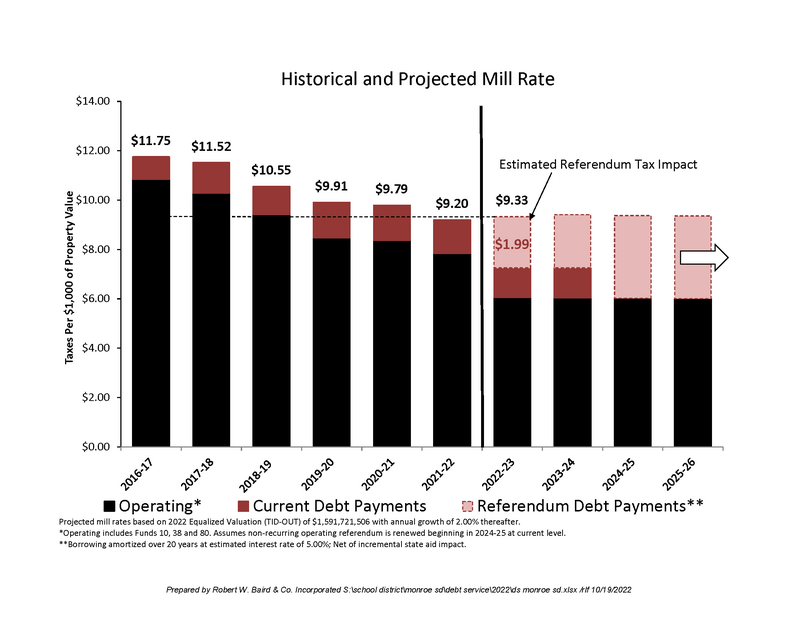

Recent Tax Bill Information

We are aware the Monroe School District property owners experienced a significant increase in their school property tax bill, the majority is related to the assigned Fair Market Value within our district.

Please Note: Although your municipal tax bills are based off your assessed value multiplied by your net assessed value rate and includes the levies for all jurisdictions, the calculation for the school district portion of your bill is based upon Department of Revenue equalized valuations. This is because each municipality may have a different average assessment ratio so the Department of Revenue uses an equalized valuation to make sure each municipality is paying their fair share of the school district levy.

Your assessed value divided by the average assessment ratio will equal your Fair Market Value which is consistent with the equalized valuation. Therefore, the example below refers to your Fair Market Value, rather than your Assessed Valuation, as the Fair Market Value is consistent with the equalized valuation that the school district’s levy and levy rate are based on.

If a property did not increase in Fair Market Value, school taxes would have increased $.13 per $1,000 or $13 per $100,000.

Example for a $200,000 property:

200 x .13 = $26 net increase over last year's school taxes.

If a property had an increase in Fair Market Value, then last year's property value increased $.13 per $1,000, but the amount of increase in Fair Market Value is taxed at the full mill rate of $9.33 per $1,000.

Example $200,000 property with an increase in Fair Market Value of $40,000 which is $240,000:

200 x .13 = $26

40 x $9.33 = $373.20

Total increase = $399.20

This is provided as the estimation for your tax bill, as the actual net tax amount due is calculated off of your assessed value. If you look at your 2021 Tax Bill you can find your Fair Market Value for last year. On your 2022 Tax Bill Fair Market Value is printed on the second row third column.

|